🤖 Manufacturing AI

Exploring real-world examples of AI applications in Mexico.

Few things are revamping the global economy quite like artificial intelligence, which is shaping entire sectors and impacting blue-collar and white-collar industries alike. Forget chatbots or cat videos: across Latin America, AI promises to modernize the way businesses of all sizes operate and grow. For example, we need only look to Mexico.

New AI tools are being employed across Mexico’s manufacturing sector in order to increase efficiency, improve product quality, and even reduce costs. Automakers in Guanajuato, for instance, are using AI for everything from quality assurance to employee safety, while precision manufacturers in states like Querétaro are now better able to forecast bottlenecks in production and minimize supplier risks.

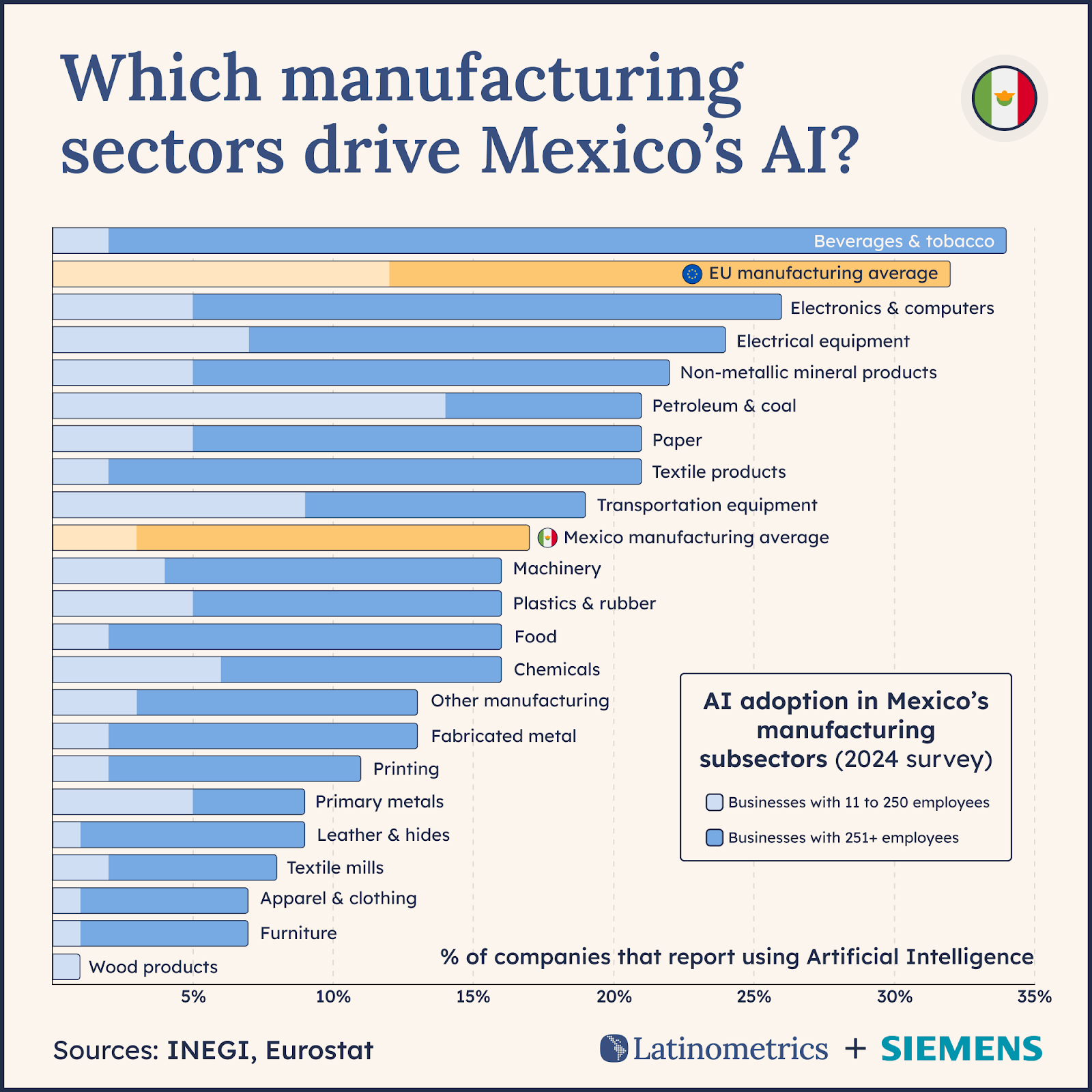

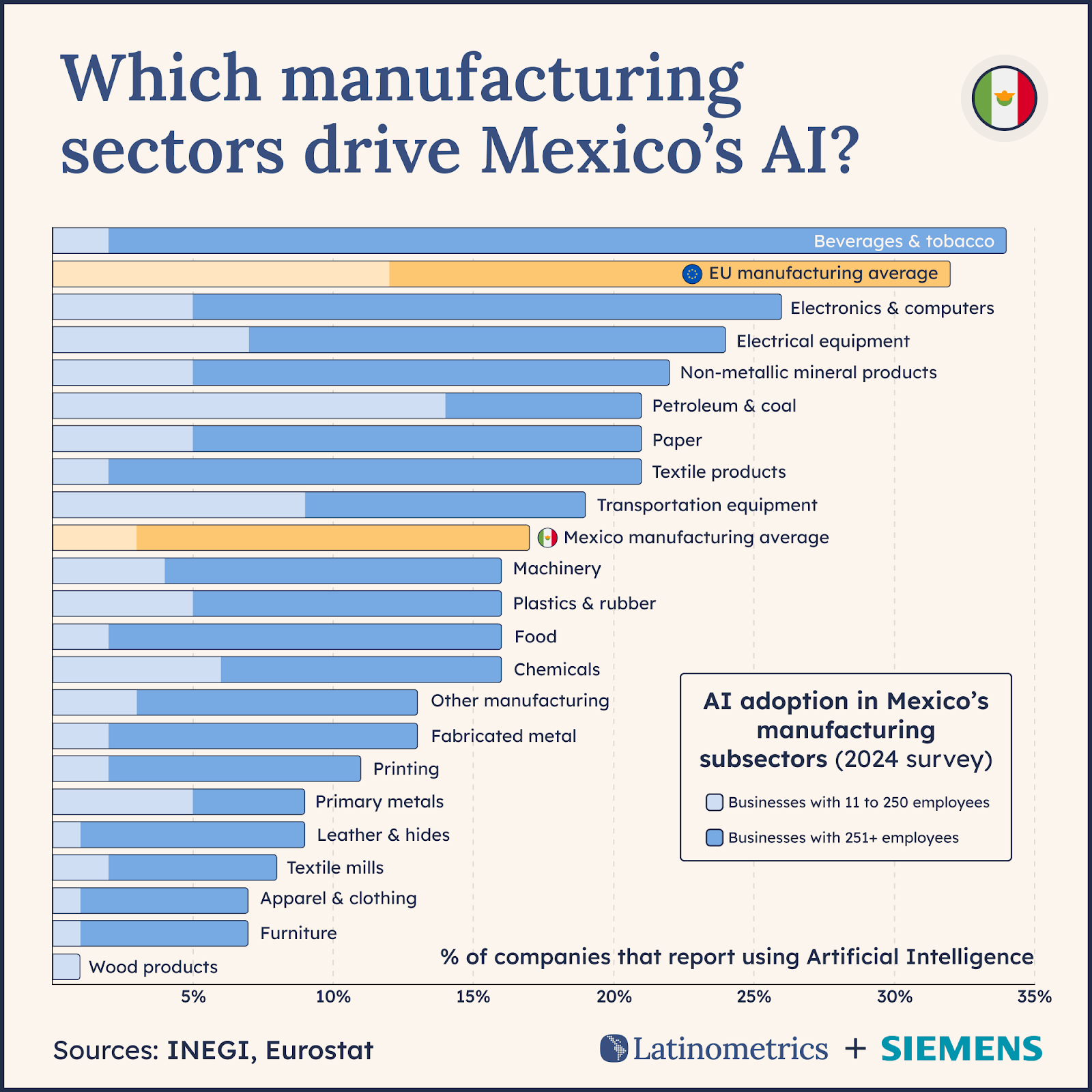

In a 2024 survey by the national statistical agency (INEGI), 18% of Mexican manufacturing firms reported using AI in their operations. For reference, this figure represents slightly over half the average rate seen across the 27-member European Union—not bad, but clearly with room for improvement.

Notably, the main opportunity for AI acceleration in Mexico is in diffusion. In subsectors like electronics or beverages & tobacco, large firms like FEMSA are already making huge strides in terms of AI adoption—in some cases even outperforming the EU average.

Where the biggest opportunity lies, especially in Mexico, is with smaller firms. Mexican small and medium-sized enterprises (SMEs) consistently have lower levels of AI adoption across all subsectors, a story which matches global trends. Across the EU, for example, AI use is also strongly size-skewed, given that 41% of large businesses employ AI tools compared to just 13% of SMEs.

Now, a few factors will help propel this SME catch-up in Mexico and beyond. The OECD has highlighted four key make-or-break enablers for small-firm AI adoption: connectivity, skills, financing, and access to AI-enabling inputs like datasets and algorithms. Mexican policymakers and businesses hoping to drive AI adoption within smaller businesses should seek to boost these acceleration levers.

One strong foundational hurdle? Only about a quarter of Mexican companies employ some type of IT, roughly paralleling the share of firms which have internet access. Addressing these areas and the big size and region gaps seen across Mexico can help to build the country’s digital base in order to scale AI use.

Cities like Monterrey are leading the way: last July, the Nuevo León Artificial Intelligence Cluster was launched with the support of local government and companies such as ALFA, CEMEX, FEMSA, and IBM. Such initiatives embrace AI as a “foundational infrastructure” for the future of industry and will seek to address gaps in connectivity, skills, and financing.

In Mexico’s manufacturing sector as in the rest of the national economy, AI poses a massive opportunity for businesses of all sizes. The true gains will be seen as smaller and increasingly dynamic firms harness this technology’s potential.