🌐 Digital Payments

Latin America's digital payments will hit $300B by 2027, but adoption remains low among low-income demographics.

The nature of payments is changing around the world.

Much in the way paper money once replaced bartering with sacks of salt, today we’re witnessing a digital revolution in which people’s relationship with their money is evolving. And Latin America is no exception, as individuals and businesses buy, sell, and save in exciting new ways.

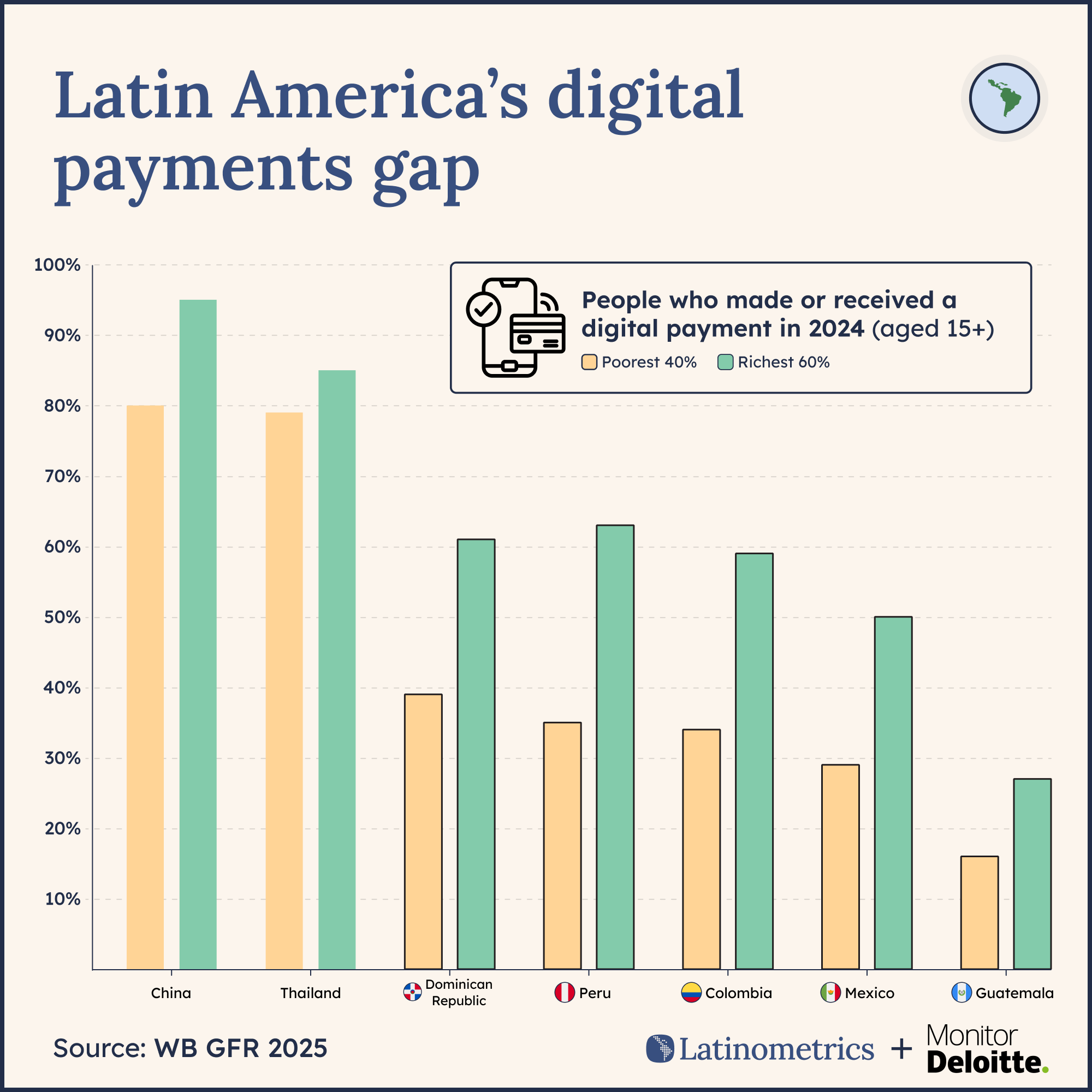

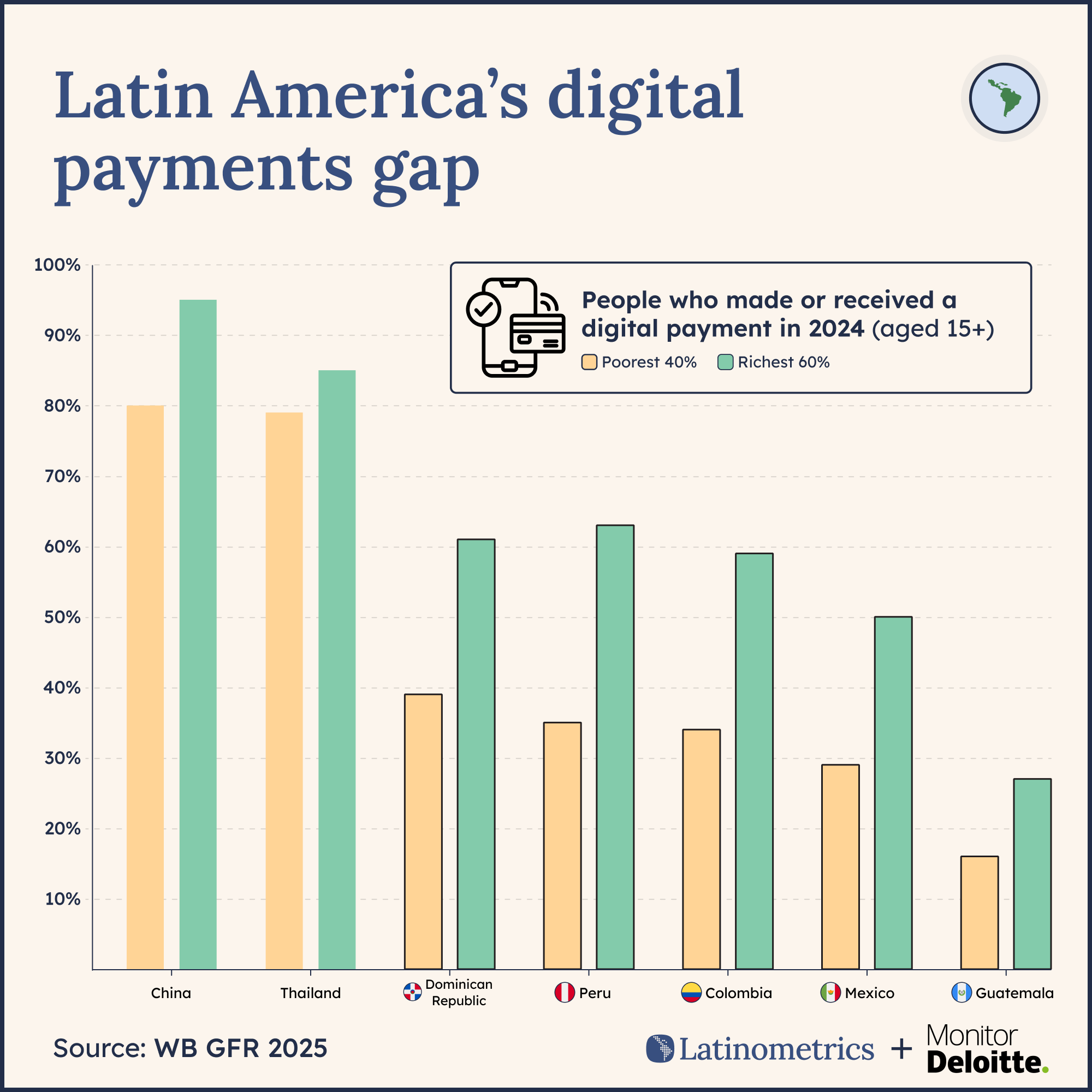

As of last year, the World Bank reports that 51% of the region has made a digital payment. But there’s also a clear economic distinction to make, between a country’s richest and poorest citizens.

Latin American countries tend to have a larger divide in terms of digital payment use between different classes of citizens when compared to even other developing countries like China or Thailand.

This divide can be explained partly by the region’s digital access gap and the fact that Latin America remains the world’s most unequal region per multilateral bodies such as the United Nations and International Monetary Fund.

But if we look more closely: The wealthiest 60% of say, Mexicans or Peruvians, have adopted digital payments to a significantly lesser extent than even the poorest 40% in China and Thaliand. Evidence that slow adoption goes beyond social classes.

The richer parts of Latin American success stories such as Peru or the Dominican Republic still lag their Asian counterparts.

There clearly remains much work to be done in broadening financial connectivity for all and ensuring people have access to new, innovative, and most importantly, legitimately useful tools for managing and moving their money. This is to say nothing of the immense work facing poorer countries like Guatemala, where roughly 17% of citizens overall are making digital payments.

Despite the gaps, though, sheer digital volumes are exploding. Electronic transactions in Latin America and the Caribbean roughly tripled between 2019 and 2023, powered by innovative new tools such as Brazil’s Pix, and total digital-payment revenue is expected to top $300B by 2027—reflecting just shy of 10% of the global market.