🪙 Stablecoins

Latin America's stablecoin market surges 42%, as countries like Argentina seek refuge from inflation.

We live in times of volatility, to say the least.

From tariffs that are imposed and taken off within the blink of an eye, rising prices on everything from food staples to housing, and political polarization leading to soaring deficits and budget crises, macroeconomic uncertainty is in abundance across Latin America and the world.

This uncertainty tends to increase currency risk, as investors and speculators move their money to safer shores. But with so many global currencies fluctuating in value, many investors and even average citizens are choosing instead to park their money in alternative assets.

Enter: stablecoins.

A stablecoin is a cryptocurrency that is theoretically tied to the value of another asset, e.g. a fiat currency or commodity. Stablecoins can be used for the sending of remittances or in crypto-investment facilitation—they can also be used to hedge against inflation, giving everyday people a way of protecting their money’s value when governments impose currency controls.

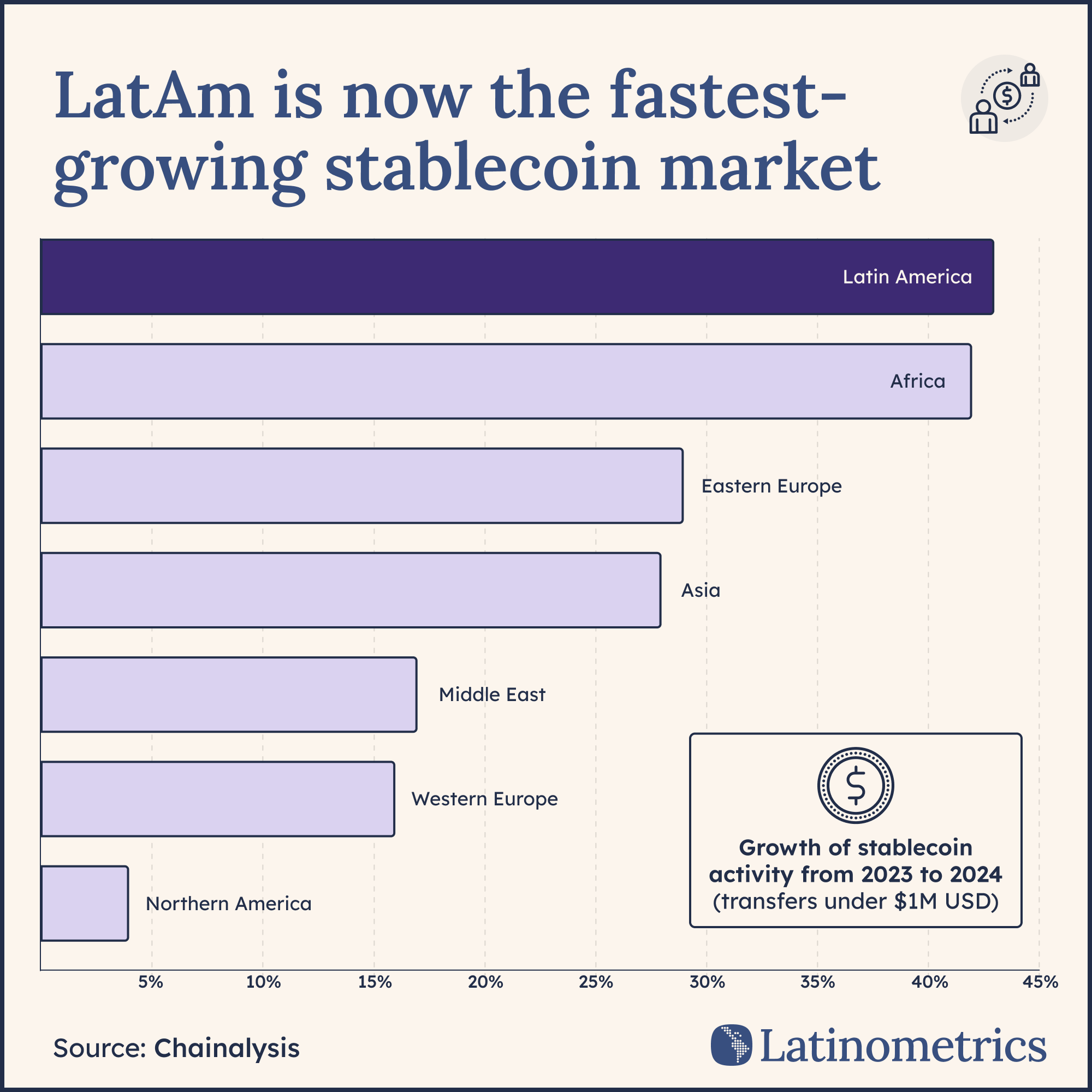

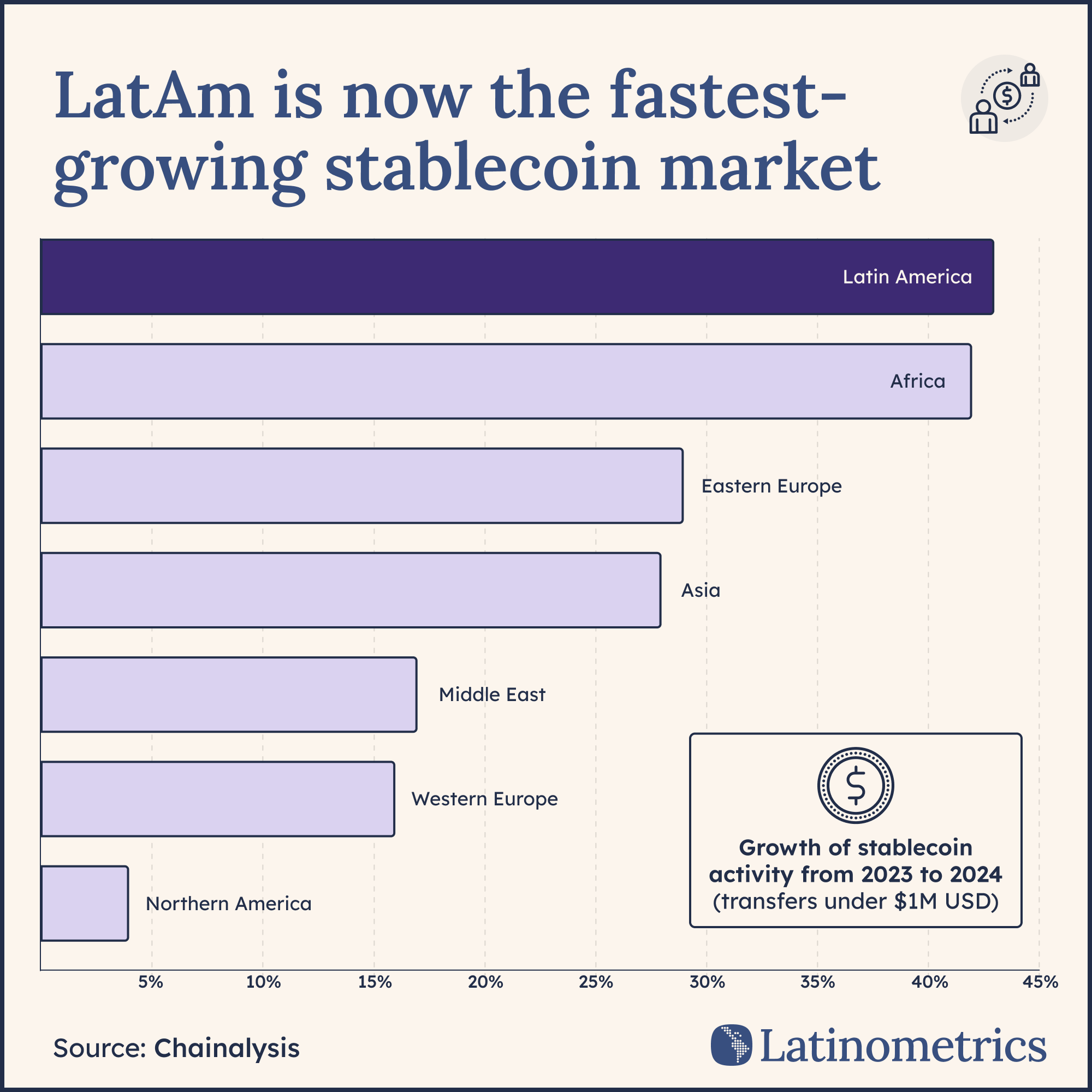

Which helps to explain why Latin America has become a booming stablecoin market, one marked by higher year-over-year growth (~42%) of stablecoin activity than anywhere else in the world.

In fact, it’s little wonder then that the two top-trading per capita markets for cryptocurrencies regionally are not Brazil and Mexico, as you might expect, but Argentina and Venezuela. Turns out that decades of economic mismanagement and hyperinflation will lead to people finding alternate places to park their money.

All this crypto-love has steep implications for Latin American governments. Higher use of independent stablecoin accounts means fewer bank deposits, particularly when the coin is pegged to the US dollar instead of local currency.

By the estimate of one recent report, $1T could flow out of emerging markets and developing countries towards stablecoins, as people protect themselves from currency depreciation by taking matters into their own hands.

Maintaining the value of local currencies has always been challenging—today, citizens have options for when governments fail to do so.